Here are the most affordable places to buy a house in Canada right now

As home prices in and around Toronto continue to be completely unaffordable to the average person despite a slightly cooling market, it makes sense that anyone with a home-ownership dream may just consider moving elsewhere in Canada, where the cost of living isn't so dang high.

The problem is that the unaffordable housing issue isn't just reserved to Toronto or Ontario, but is a nationwide problem. But, there are still some places where you can nab a home for not just below Toronto's high prices, but below the national average as well.

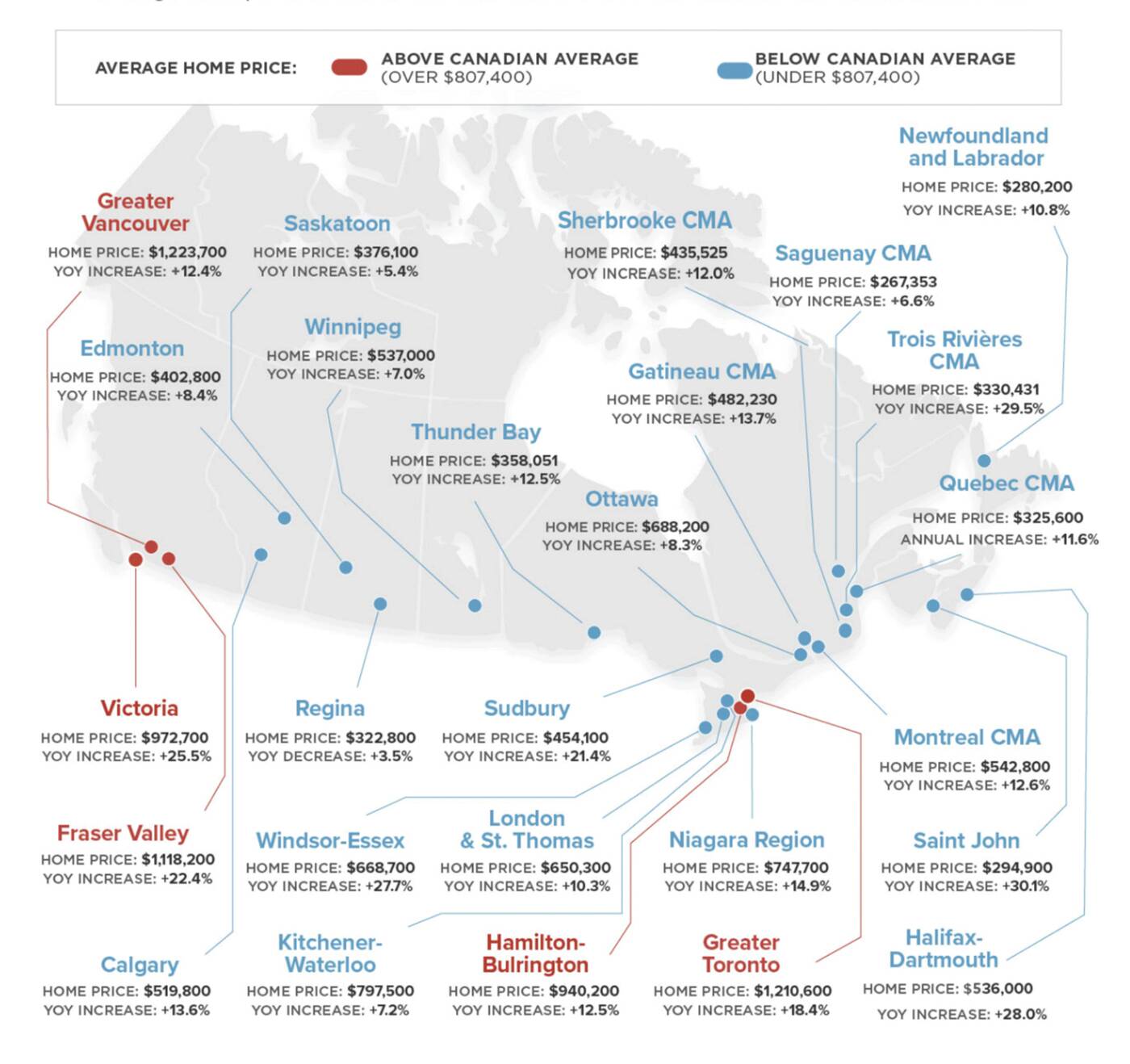

The experts at real estate listing site Zoocasa, in their latest assessment of the Canadian real estate landscape, were kind enough to round up all of the regions where prices (though way up year-over-year across the board) are still sitting below what the typical home in Canada currently costs — and surprisingly, a few are actually in Ontario.

With numbers from the Canadian Real Estate Association, the firm found that the following 20 areas are the cheapest to buy a home in in Canada, at the moment:

- Saguenay, Quebec, where the average home is just $267,353

- Newfoundland and Labrador, with an average price of $280,200

- Saint John, New Brunswick, at $294,900

- Regina, Saskatchewan, at $322,800

- Quebec CMA, at $325,600

- Trois-Rivières, Quebec, at $330,431

- Thunder Bay, Ontario, at $358,051

- Saskatoon, Saskatchewan, at $376,100

- Edmonton, Alberta, at $402,800

- Sherbrooke, Quebec CMA, at $435,525

- Sudbury, Ontario, at $454,100

- Gatineau, Quebec, CMA at $482,230

- Calgary, Alberta, at $519,800

- Halifax-Dartmouth, Nova Scotia, at $536,000

- Winnipeg, Manitoba, at $537,000

- Montreal, Quebec CMA, at $542,800

- London & St. Thomas, Ontario at $650,300

- Windsor-Essex, Ontario at $668,700

- Ottawa, Ontario at $688,200

- Niagara Region, Ontario at $747,700

Zoocasa notes that, largely prompted by higher interest rates, home sales numbers are way down (23.9 per cent from last year), with more listings on the market, and thus more buyer power.

"As the cost of borrowing increases, buyer uncertainty is now the main factor affecting the housing market. In previous months, the limited housing supply was leading to a sense of urgency in many buyers. Potential buyers are now choosing to stay on the sidelines as they wait and see how the rate increases play out," their report reads.

"The upward pressure on home prices has slowed, with many major areas across the country seeing month-to-month dips. While still 15.1% higher than last year, Canada’s average home price of $807,400 in June was 1.9 per cent lower than May."

Latest Videos

Latest Videos

Join the conversation Load comments