Experts say there's zero chance of affordability returning to Toronto's real estate market

Toronto's housing market may have already gotten about as affordable as it's ever going to get, economists are now saying, with inflated mortgage interest rates pushing sales activity way down, and with it, prices, at least to some degree.

But, even during this respite from the usual freneticism of the market, it will still run you a very unreasonable $1,118,374 for the typical home in the GTA at present — and the experts don't expect this to drop much lower, even if the economy completely tanks.

"After years of being priced out of the market, many prospective Toronto homebuyers now sense an opening with a recession looming. But even in the direst of economic scenarios, we don't see affordability returning to Canada's largest city anytime soon," reads a new report called How Low Can Prices Go in T.O.? from cooperative financial group Desjardins.

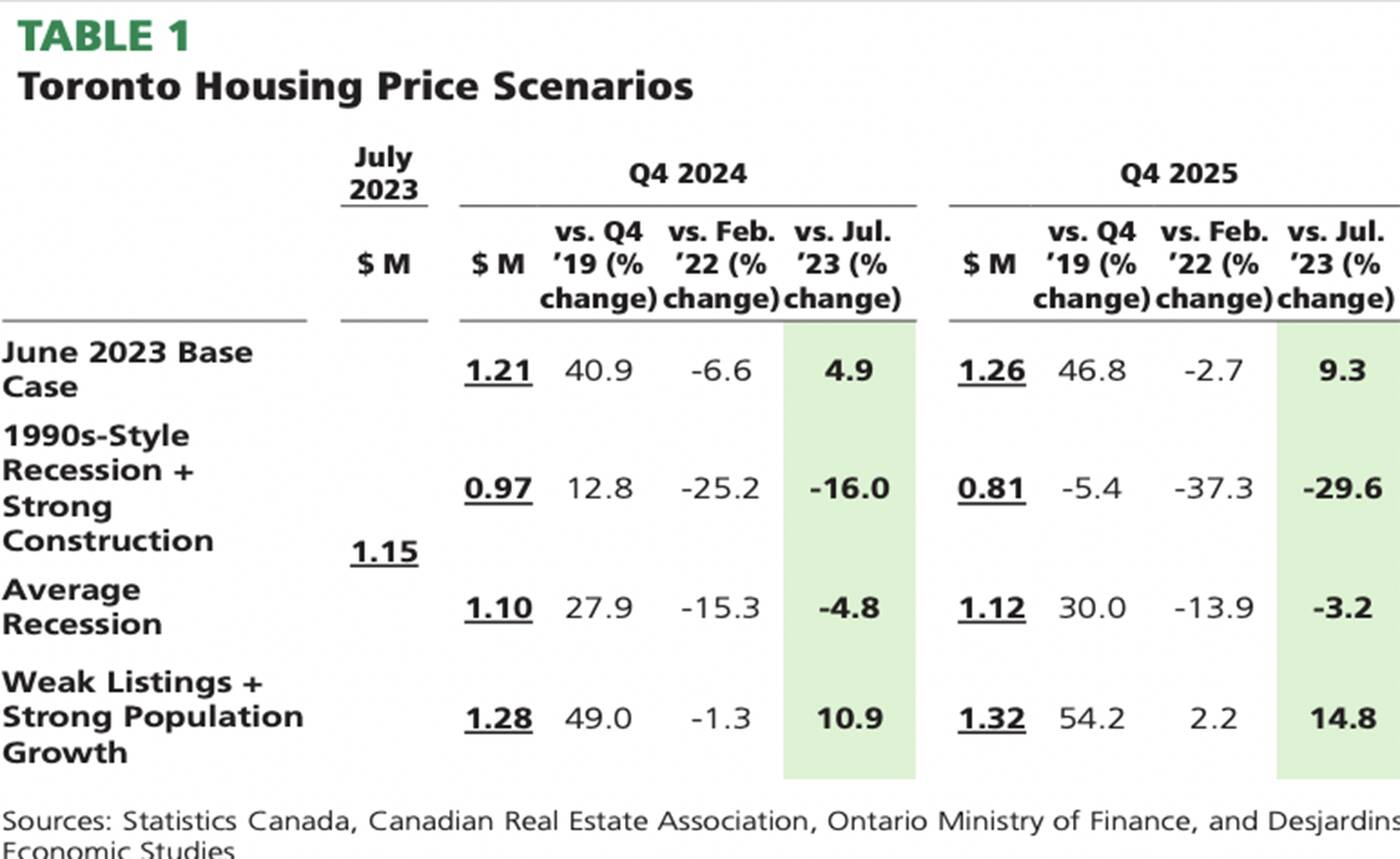

In the document, the firm estimates where average prices would land in different potential financial scenarios, including a worst-case recession similar to that of the early 1990s.

In the document, the firm estimates where average prices would land in different potential financial scenarios, including a worst-case recession similar to that of the early 1990s.

Unfortunately, their outlook isn't promising for anyone still holding onto the dream of securing a place of their own in the nation's largest city, no matter what lies on the horizon as far as interest rate hikes or economic collapse.

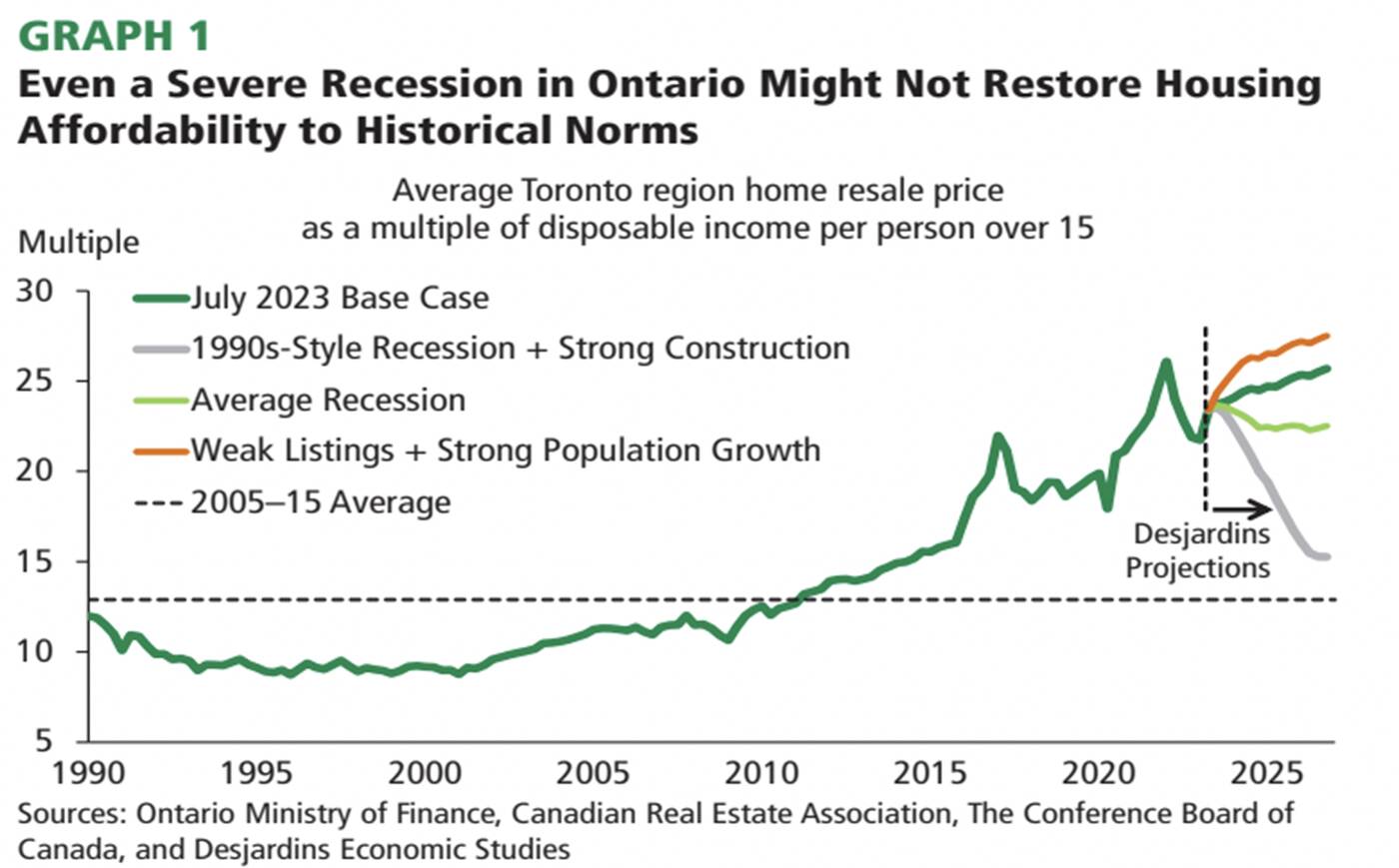

"Even if that improbable outcome were to materialize within the next three years, it would only bring Toronto's home price-to-per-capita disposable income ratio back to still-stretched, late-2015 levels," write Desjardins's principal economist and chief economist and strategist.

Though they project that in this situation, home values could fall as much as $340,000 (or 30 per cent) from the July 2023 average, this would come alongside widespread job losses and a $35 billion reduction in overall employment income in Ontario that would render people far less able to make such a purchase.

"A more bullish house price trajectory is also possible," they also note, citing a scenario where consistently low listings and strong population growth — led by record immigration targets that other experts have said are not tenable — would drive prices even higher than their February 2022 peak in less than two years' time.

"A more bullish house price trajectory is also possible," they also note, citing a scenario where consistently low listings and strong population growth — led by record immigration targets that other experts have said are not tenable — would drive prices even higher than their February 2022 peak in less than two years' time.

Like so many others, the authorities underscore how the construction of more housing in the region, particularly designated affordable housing, is absolutely crucial.

Canada's sky-high interest rates hammering new home construction https://t.co/WdsPiplt4l #Canada #RealEstate

— blogTO (@blogTO) September 2, 2023

Unfortunately, interest rates mean that thousands of units due to be coming to the GTA are now delayed.

"Plans to boost the supply of affordable housing can't fall short. It's just not an option... All levels of government and the private sector have to work together to address the herculean challenge of adequately increasing new homebuilding. Toronto's — and indeed Canada's — status as a welcoming and prosperous place to live depends on it."

Google Street View

Latest Videos

Latest Videos

Join the conversation Load comments