Here are the cities near Toronto where it's smarter to buy than rent a home right now

To rent or to buy? That is the question for many current and prospective Toronto residents as the GTA's unstable teeter-totter of a real estate market tilts again, this time toward home ownership — but not universally so.

"As interest rates continue to rise this year, many are shifting their real estate goals from buying to renting," reads a report published Wednesday by the real estate data analysis team at Zoocasa.

"Although, according to the Toronto and Greater Toronto Area (GTA) Rent Report from TorontoRentals.com, average rent prices in the GTA are up 19% annually."

One might surmise that this means we're screwed (financially) either way, but that's not necessarily the case, depending on where you wish to live.

Yes, interest rates are making it harder for people to buy homes in Toronto, but the average sale price of those homes have actually been declining in many parts of the GTA for months.

With home prices down from the historic highs of February and average rent prices skyrocketing, people in some parts of the region may be even more likely to buy at this point than rent.

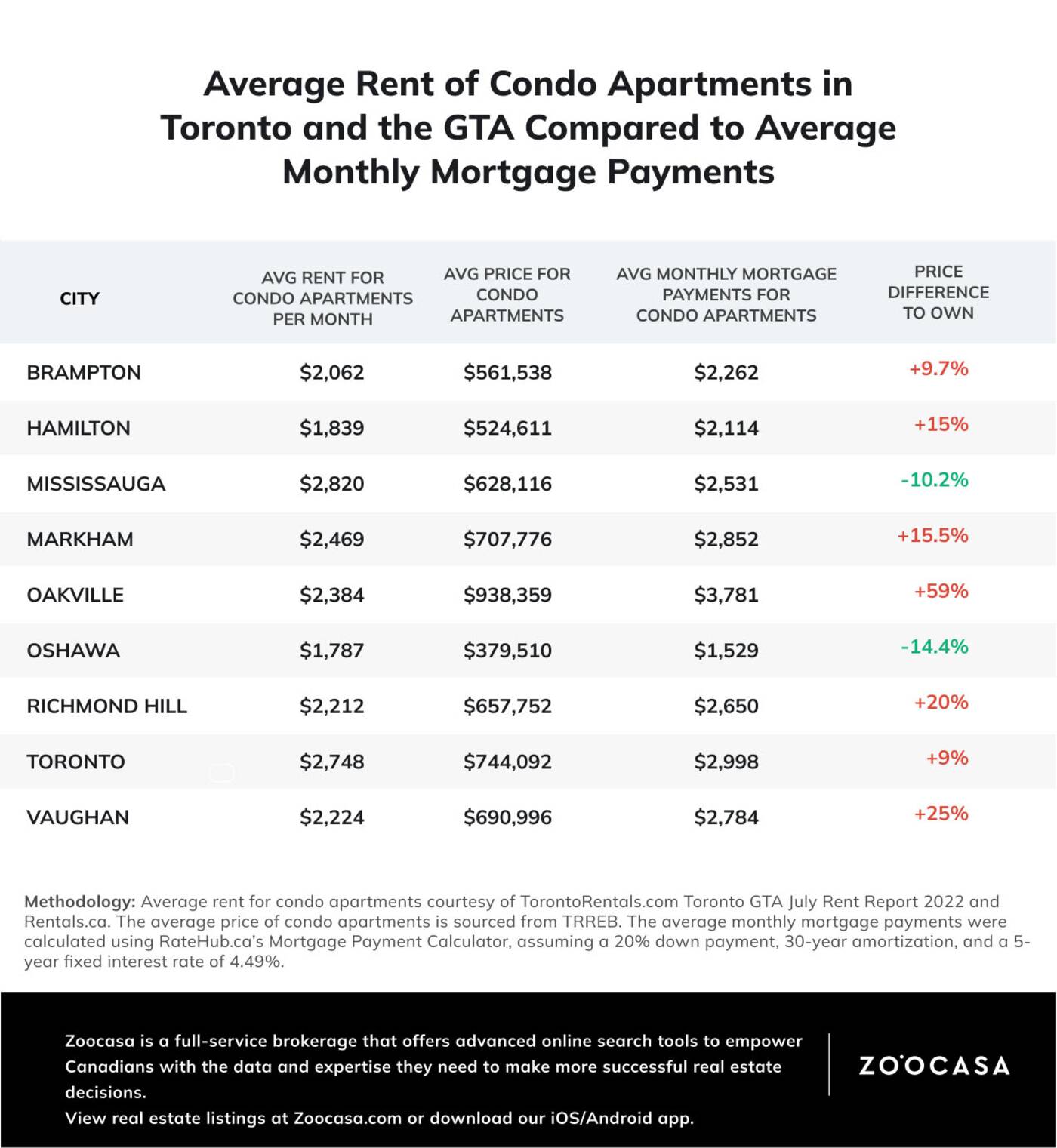

Zoocasa crunched some numbers to help people figure out whether now is the right time to buy or continue renting, comparing the most recent available GTA rental price data (from June) to average July home prices.

The research focused specifically on condominium apartments, contrasting the average rent price per month for a condo against the average monthly mortgage payment for a condo (calculated assuming a 20 per cent down payment, 30-year amortization, and a 5-year fixed interest rate of 4.49 per cent).

What they found — surprise surprise — was that the situation varies widely by region.

Mississauga and Oshawa both have conditions in place for a market where buying will cost you less per month (currently) than renting would, if you already have a downpayment in hand.

Mississauga and Oshawa both have conditions in place for a market where buying will cost you less per month (currently) than renting would, if you already have a downpayment in hand.

The average going rent for a condo in Mississauga is $2,820 while, based on average condo sales prices in the region, a mortgage calculated using the factors above would be about 10 per cent cheaper at $2,531.

The gap between rent and mortgage prices jumped even higher for Oshawa, where the average condo rent is $1,787 and the average mortgage (based on the current average condo price $379,510) would be $1,529 — a difference of more than 14 per cent.

"For Brampton and Toronto, the price difference is relatively small, and as rent prices are projected to continue increasing, purchasing in these cities may lead to long-term savings," advises Zoocasa.

"On the other hand, in Oakville, the price to own is substantially higher than to rent which may be driven by the demand to buy condo apartments in the city."

The bottom line: It's still cheaper to rent than to buy a condo in much — but not all — of the Greater Toronto Area this summer. Only time will tell how long this remains the case.

Latest Videos

Latest Videos

Join the conversation Load comments