Get to know a Toronto startup: Hubdoc

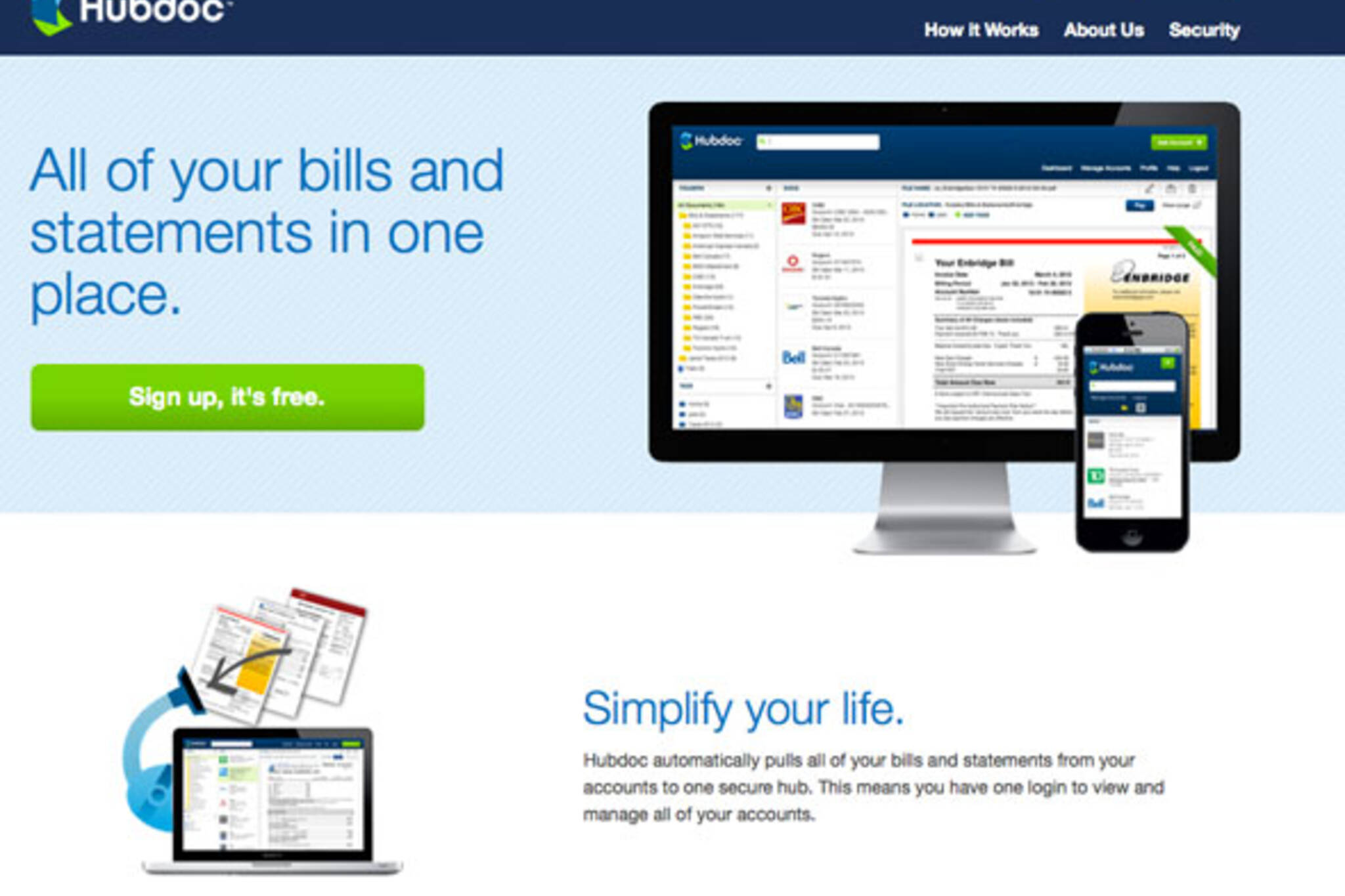

Tired of filing cabinets for your paper bills and managing multiple logins and websites for your electronic ones? Toronto's Hubdoc is a new startup aiming to make billing easier. Co-founded by Jamie McDonald and Jamie Shulman, HubDoc gives you one online place for all of your bills and statements ensuring that you never miss a payment and always have easy access to your billing history.

Located at Yonge & Eglinton, Hubdoc works by securely connecting your existing accounts and syncing your bills as they come in. It will aggregate your statements, summarize your outstanding balances, and alert you of your due dates. While still new, it is already integrated with many Canadian companies including CIBC, Toronto Hydro, Rogers, and more.

I recently had the chance to sit down with co-founder Jamie McDonald. The former CEO of Sparkroom (acquired by Neltel) and a former VP at Expedia.com, he is a seasoned entrepreneur who had a lot say about his team's new product:

What is HubDoc and how does it work? What are your biggest features?

Hubdoc is one place for all of your bills and statements. With companies beginning to charge $2 per month for paper bills, more and more consumers are choosing e-billing - but it is still not as convenient as your mailbox at home. Consumers need to remember multiple logins and visit multiple websites to access their statements. Hubdoc solves this problem by consolidating the delivery, management and storage of bills and statements into one spot - all for free.

Just connect your accounts and we will automatically fetch your bills, notify you when there are new statements and remind you to make your payments.

What are your biggest features?

Our biggest features include automatically fetching bills, alerting you when they are due, and graphs and stats to help you track your spending

What is your target market? Why might someone use your product?

We are targeting all consumers, but largely people over the age of 25 who have 5 or more bills a months. We believe that this is a product that these people want and we want to continue to find more people like them to use it.

How many users do you have and how to you plan to grow?

We launched our beta to Canadian consumers on March 25, 2013. We do not disclose our user figures, but are pleased with consumer growth in its first two months.

Our growth strategies range from social media and search engine optimization to building partnerships with the companies that have a lot of users, send a lot of mail, and would save a lot of money money by going digital.

How secure is your product?

Hubdoc is built with multiple layers of security to protect your personal information. Our logins are secured and all data is encrypted using TLS technology - the same algorithm utilized by the top U.S. financial institutions. We also use third-party verification by having industry leaders like McAfee perform daily scans on our site and use TRUSTe to certify our privacy practices.

Our data centres are also monitored by closed circuit television systems and protected by onsite security teams around the clock. All access is controlled by a military-grade passcard system and they comply with national, international and industry standards relating to security

Further, we pull all of your bills and statements from your accounts, but we do not have the ability to make account changes of any kind. This means that no one, including you, can use your Hubdoc account to access your money or make changes to any of your household accounts

Who are your competitors? How are you different?

In Canada, we compete with ePost, Canada Post's digital offering. We differentiate ourselves in that we have access to more bills and our product is much easier to use - something we hear often from our customers.

In the US, there are a number of different companies trying to build similar products including Manilla and Check, but neither of those companies have any real presence in Canada. We have some unique distribution relationships that we are developing that we believe can help us compete effectively in the US market.

Have you raised funding?

Yes! We raised funding from a strategic investor, although we are not disclosing the amount or the company that invested at this time.

What is your monetization strategy?

Our premise, similar to mint.com, is that we will offer a free product to consumers, but be able to make offers on behalf of partners that save their customers money.

For example, if your credit card has an interest rate of 20%, then we will offer you one that has an interest rate of 10%, instead.

What are your next steps?

We want to build a really great payment system to allow one-click payments, launch our product on Android and iOS, and expand into the US as well.

Ultimately, we aim to be a centralized billing platform that becomes a replacement for your filing cabinet over time.

Latest Videos

Latest Videos

Join the conversation Load comments