Not even high interest rates can curb Toronto housing prices and it's about to get worse

Inflated interest rates may have made real estate in already-overpriced Toronto completely unaffordable to all but the ultra-wealthy in recent months, but even if mortgage and tax bills on the average Toronto home now amount to upwards of $7,000 per month, prices have yet to drop to match the decline in market activity.

Sales for both condos and homes in the GTA have been tanking, but even with these figures down a shocking amount from where they were last year, experts are not expecting prices to fall in line — in fact, they're expected to get much higher.

The latest report from the Toronto Regional Real Estate Board (TRREB) states that while high lending rates have slowed the perennially red-hot market, population growth is expected to spur further demand and keep prices high.

We’re all first hand experts of this.

— педик made of spicy bear meat 🐻 (@TapeDeckChris) July 28, 2023

As TD Economics said in July, record immigration targets are contributing to a population surge that is in turn causing "textbook demand shock" and raising prices for goods and services across the board — during a time of unprecedented inflation, no less — especially in our already-pressed real estate market.

"Despite the market being better-supplied with listings, the average selling price was up year-over-year," TRREB wrote on Wednesday.

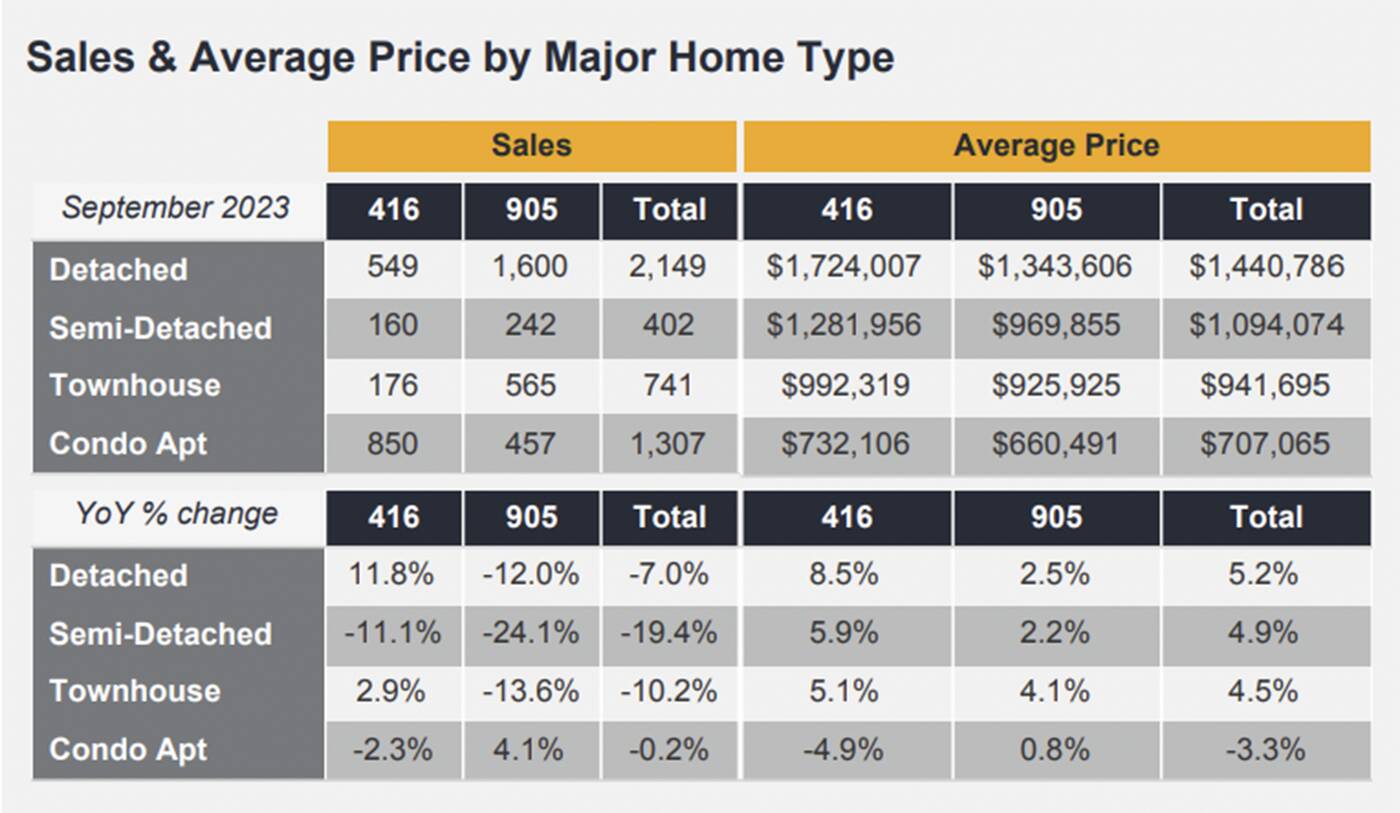

The newest stats from TRREB show that even in the face of ridiculous mortgage rates, home prices in the GTA won't budge. Chart from TRREB.

"The consensus view is that borrowing costs will remain elevated until mid-2024, after which they will start to trend lower. This suggests that we should start to see a marked uptick in demand for ownership housing in the second half of next year, as lower rates and record population growth spur an increase in buyers."

This, of course, will mean ever-higher prices, as has historically been the case for Toronto in recent memory, aside from that welcome little COVID blip.

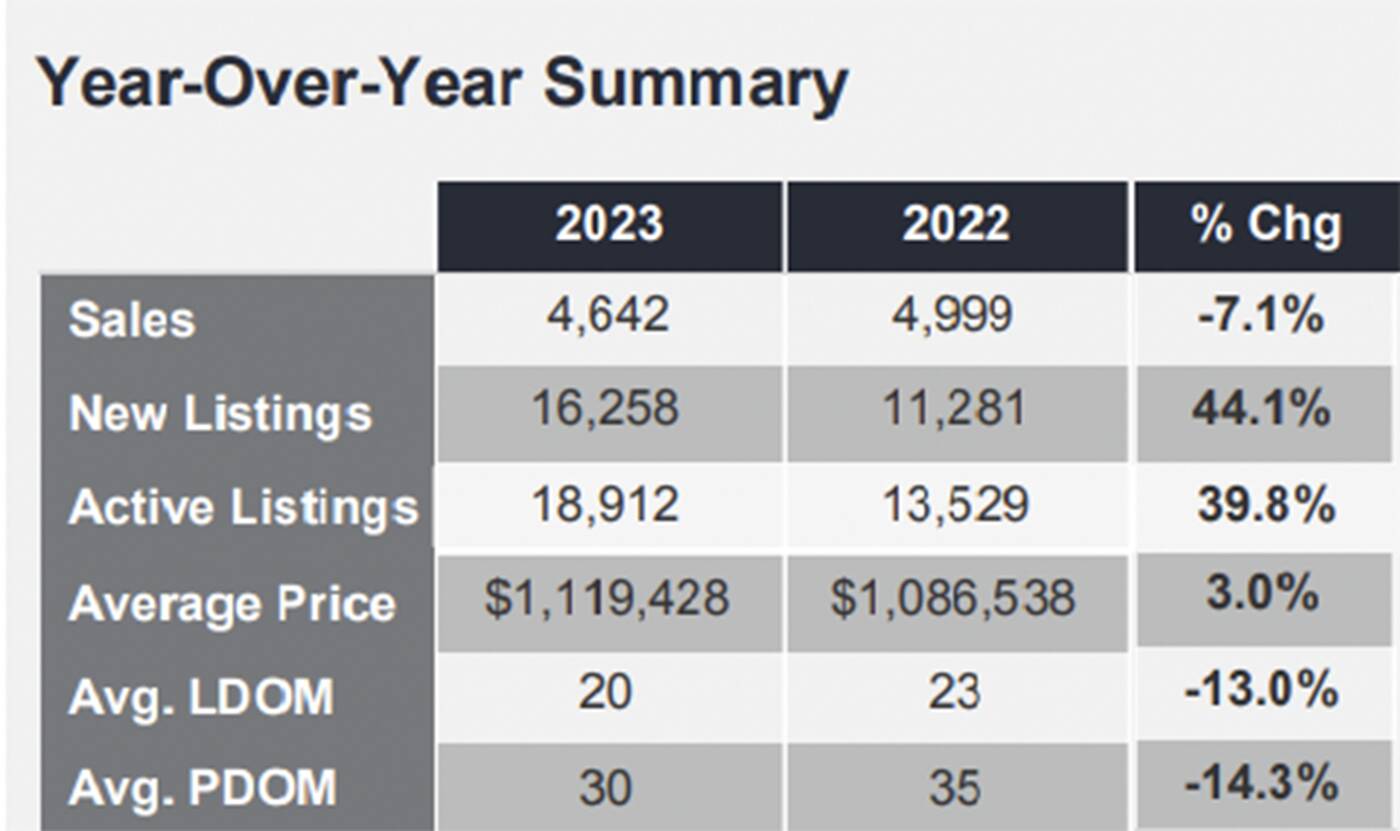

While the number of homes sold across the Toronto area was down 7.1 per cent year-over-year in September, the average selling price was up 3 per cent. And, the number of homes on the market was markedly higher than this time last year, too.

Sales activity is slightly down, but new listings are way up, and more demand is only going to make demand stronger, competition more fierce and prices, higher, regardless of interest rates. Chart from TRREB.

TRREB, meanwhile, is involved in a class-action suit that alleges they and other industry stakeholders have been price-fixing realtor commission rates for more than a decade.

But given that we're in one of the most overvalued housing markets in the world that only a market crash could help remedy, the allegations, if true, may be among the least of our concerns.

Latest Videos

Latest Videos

Join the conversation Load comments