Here's how long you need to save up to buy a condo in Toronto

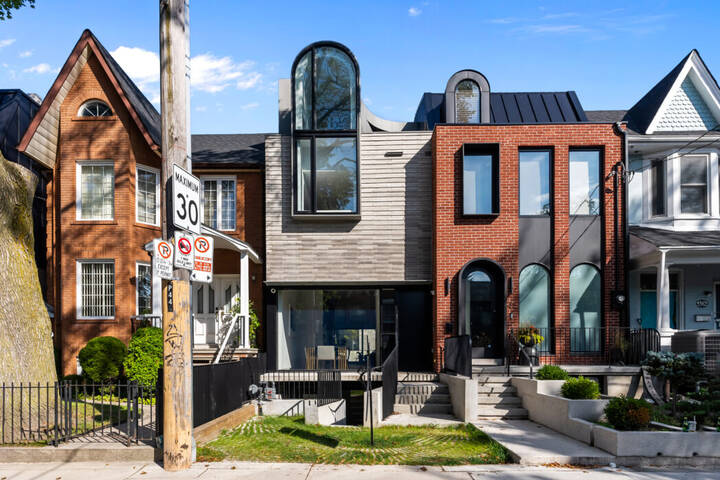

Buying your first condo can be a stressful experience, given all the ups and downs of Toronto's real estate market. Instead of grappling with the city's soaring rent prices, you also might be tempted to invest in the long haul and save up to purchase your own condo apartment instead.

Apartments are great entry-level homes for first-time buyers, and tend to be more affordable for solo budgets when compared to prices for detached homes.

If this is the route you choose, you might be wondering exactly how long (and how much of your income) you'll have to set aside in order to afford an apartment in one of Canada's most expensive cities.

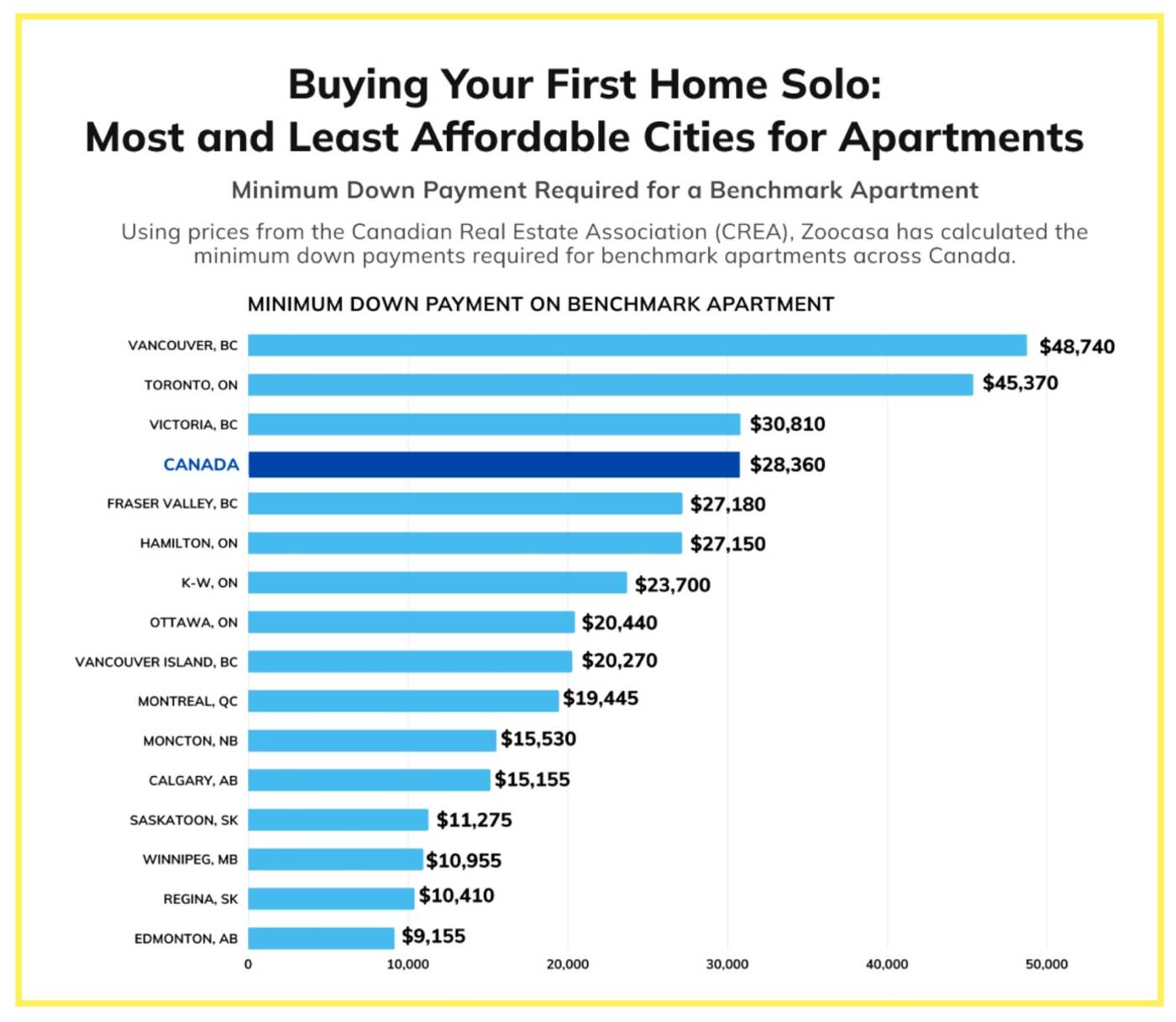

A recent study by Zoocasa analyzed the minimum down payment required to purchase a benchmark apartment in 15 regions across the country, and compared it to the after-tax single-household median incomes earned in each.

The study also calculated how many months it would take a solo dweller to save up for the down payment, assuming they contribute 100 per cent of their income annually.

The report used prices based on March 2023 from the Canadian Real Estate Association (CREA).

Source: Zoocasa.

Zoocasa found that the minimum down payment on a benchmark apartment in Toronto was $45,370, which is considerably more than Canada's average minimum down payment of $28,360.

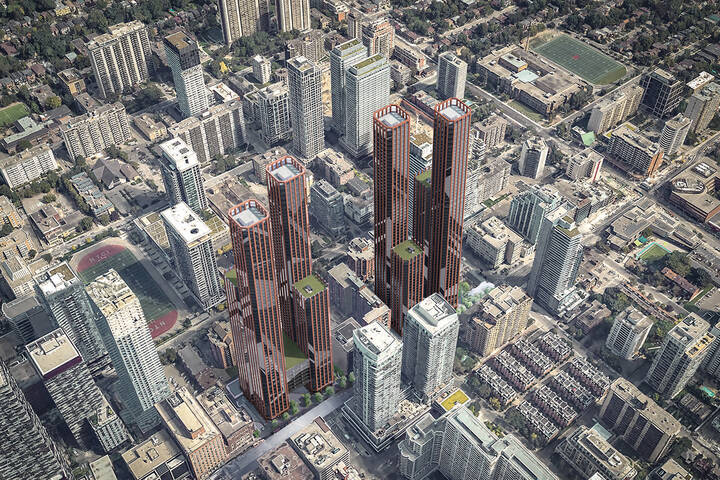

The study discovered that Canada's most expensive markets, Vancouver and Toronto, require condo minimum down payments greater than the median after-tax income of single households. This means that solo dwellers must save their income for more than a year before being able to afford a benchmark-priced apartment.

Source: Zoocasa.

Given a yearly after-tax salary of $41,200, solo buyers in Toronto would have to save for 13.2 months in order to be able to afford the $45,370 down payment, according to the report. This calculation is based on a benchmark apartment price of $703,700 in Toronto.

Out of all the regions analyzed, Vancouver was by far the most expensive city in this regard. Single homebuyers would have to save for 13.9 months before being able to pay the necessary $48,740 down payment.

It's worth noting that it's impossible for one to preserve their entire after-tax salary for the sole purpose of purchasing a condo, so these wait times are likely much longer, depending on your income.

While all the calculations are subject to change, the study does highlight how unaffordable Toronto has become when compared to other major cities across Canada.

Latest Videos

Latest Videos

Join the conversation Load comments