Toronto had fewer new condo sales than the rest of the GTA for the first time ever in 2020

It's no secret that the condo market in Toronto was completely rocked in 2020, with sales volumes plummeting year-over-year and prices actually declining at points, all while the market for single-family homes continued to boom despite the pandemic, in characteristic fashion.

Freshly-released numbers from Urbanation show a new aspect of just how drastic the turn in the market was last year, in regards to new builds in particular.

According to the condo analysis firm's latest Condominium Market Survey, there were actually fewer new condo transactions in the notoriously condo-happy urban centre of Toronto last year than there were in surrounding suburban communities for the first time ever.

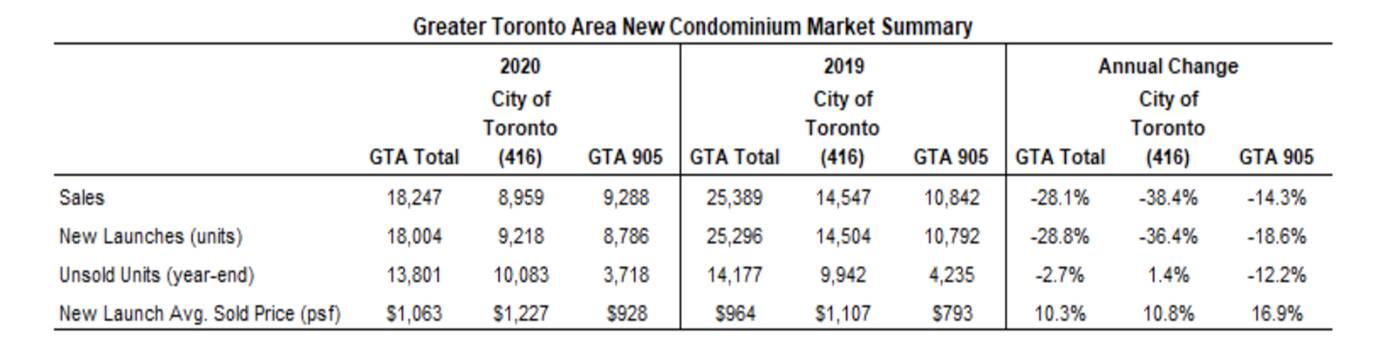

The report indicates that sales of new units in the GTA as a whole were down 28 per cent in 2020 compared to 2019, hitting a record low not seen since 2013, a whopping 15 per cent below the 10-year average.

For Toronto specifically, the stats were even worse: there were 38 per cent fewer sales last year than in 2019, and the number of units sold hit a 15-year low.

And, a total of 9,288 of the 18,247 new condos sold over the course of the year — that is, just more than half — were shockingly in the rest of the GTA, not Toronto proper.

905 Overtakes 416 for GTA New Condo Sales in 2020:https://t.co/n3VSHOV0KV pic.twitter.com/b3dY206DQ9

— Urbanation Inc. (@Urbanation) February 1, 2021

A whole lot of units also remained unsold by the end of 2020, more in Toronto than in previous years: the equivalent of 13.5 months of supply was still on the market in the 416 by year's end, compared to 4.8 months of supply that remained unsold in the 905, which was actually down 12 per cent from 2019.

This is all amid construction that was not assuaged by COVID-19, with 9 per cent more new units built than the year prior.

By the end of the year, a record high 81,029 condominiums were under construction across the GTA — but with falling sales, one could ask the question, for who?

Due to a glut of units that owners could no longer rent out as Airbnbs, declines in immigration and international students, and the rising vacancy rates and tumbling rent prices that came as a result of the health crisis, many who purchased condos for investment properties were scrambling to get rid of them.

Others, meanwhile, were looking to sell their primary residences as they fled the city to seek larger spaces from which to work from home and wait out the lockdown.

As a result, the landscape became great for prospective homebuyers looking for a deal in one of the most unaffordable housing markets in the world, but not so great for those looking to sell their properties for a profit that used to be guaranteed.

How sales of new condos in the 905 and the 416 compared last year. Chart from Urbanation.

The move to GTA real estate was fed, in part, by the affordability factor, which became all the more appealing amid 2020's financial precarity, and the fact that people had fewer reasons to stay in the downtown core.

But per the Urbanation data, selling prices for new condos in both Toronto and the wider GTA actually increased pretty drastically, despite reports otherwise at various points during the year: up 10.8 per cent to $1,227 per square foot in the city, and 16.9 per cent to $928 per square foot in the 905 by year's end.

And, condos in the suburbs became physically smaller, on average, while the opposite happened in Toronto proper, which is somewhat counterintuitive.

"Interestingly, the average size of new launches in the City of Toronto increased from 676 sf in 2019 to 706 sf in 2020, while the average size of new launches in the 905 region declined from 735 sf in 2019 to 690 sf in 2020," the experts note.

Another wild real estate phenomenon of the year was the fact that rents became cheaper on average in the city centre than in the 'burbs.

Essentially, the only thing we can count on in Toronto-area real estate, global pandemic or not, is its ultimate unpredictability and, perhaps, increasing unaffordability.

Hector Vasquez

Latest Videos

Latest Videos

Join the conversation Load comments