Toronto home sales have plummeted by nearly 50 per cent in just the last year

Higher borrowing costs continued to weigh on the Great Toronto Area housing market in November, dragging home sales down nearly 50 per cent compared to a year ago.

According to the Toronto Regional Real Estate Board (TRREB)'s latest Market Watch report, just 4,544 homes were sold across the GTA last month, a 49.4 per cent decline from November 2021. In October, sales were down 44.1 per cent year-over-year.

The “marked” decline follows the trend that has played out across the region since the Bank of Canada began raising interest rates in the spring. The BoC has hiked rates six times since March in an attempt to rein in inflation, with a seventh increase expected on December 7.

While higher borrowing costs represent a "short-term shock to the housing market," TRREB President Kevin Crigger said the demand for housing will "pick up strongly" over the medium to long-term as immigration to the GTA reaches record levels.

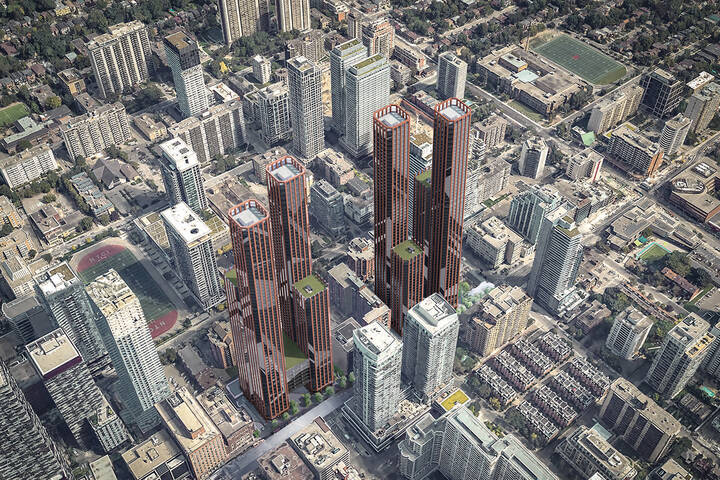

"The long-term problem for policymakers will not be inflation and borrowing costs, but rather ensuring we have enough housing to accommodate population growth," Crigger said.

TRREB CEO John DiMichele noted that although there has been progress on housing supply and related governance in 2022, new policies, such as the "More Homes Built Faster Act," need to turn into results, fast, lest affordability worsen.

At 8,880, new listings in the GTA were down by a "substantial" 11.4 per cent year-over-year in November, and sat at a "very low" level historically. With supply staying low, average selling prices have hovered around the $1,080,000 mark since August.

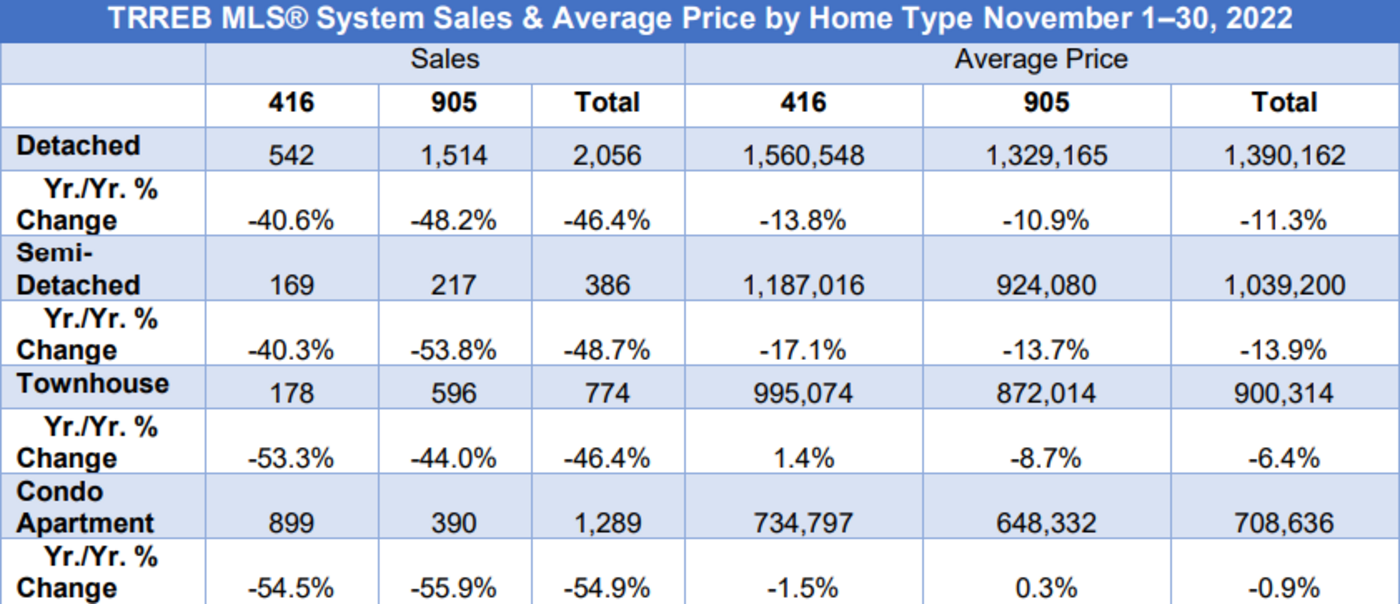

The average selling price for all home types in the GTA hit $1,079,395 in November, a 7.2 per cent annual decline. The board noted that greater declines were seen in more expensive market segments, such as detached (down 11.3 per cent) and semi-detached (down 13.9 per cent) houses.

Toronto Regional Real Estate Board

Across the region, the largest annual price decline was seen in Toronto's semi-detached houses, which fell 17.1 per cent in November to $1,187,016. Meanwhile, the average price of a townhouse in the city increased 1.4 per cent annually, to $995,074.

Despite a 13.8 per cent annual decline, detached houses in Toronto remained the priciest properties in the GTA, with an average price of $1,560,548. Condos in the city retained an air of affordability, with prices falling 1.5 per cent to $734,797.

"Selling prices declined from the early year peak as market conditions became more balanced and homebuyers have sought to mitigate the impact of higher borrowing costs," said TRREB Chief Market Analyst Jason Mercer.

"With that being said, the marked downward price trend experienced in the spring has come to an end. Selling prices have flatlined alongside average monthly mortgage payments since the summer."

According to a recent report from RE/MAX Canada, the average price of a home in the GTA is expected to fall another 11.8 per cent in 2023.

Latest Videos

Latest Videos

Join the conversation Load comments