Toronto rent prices just took a shocking 20% leap with no relief in sight

If your skyrocketing gas and grocery bills weren't enough, Toronto rental prices just keep on climbing back to pre-lockdown levels, and experts expect rents will only continue their ascent in the months to come.

Living in the big city is an increasingly costly commitment, and while average rental prices are rising nationwide, Toronto renters are feeling more pressure than ever.

After a slight reprieve, Toronto rental prices surged in May, rising 16.5 per cent from $1,998 in May 2021 to $2,327 one year later. And it just got a whole lot worse.

According to the latest National Rent Report from Rentals.ca and Bullpen Research & Consulting, that number has only climbed in the weeks since, as the average rent in the city jumped by 20 per cent year-over year in June to an unbelievable monthly cost of $2,463.

Only a couple of months earlier, the average monthly cost hovered just below $2,200, a testament to just how quickly renters' situations can change in the city.

The leap in rental prices follows a 9.2 per cent decline the previous June and a 7.8 per cent decrease in June 2020.

A one-bedroom unit will now cost a renter an average of $2,192, an annual increase of 18.5 per cent, while a two-bedroom unit will run you an average of $3,115, increasing 23.4 per cent over last June.

On a month-over-month basis, one-bedroom rents increased 2.8 per cent while two-bedroom rents climbed by 3.8 per cent.

Only Vancouver recorded higher rental prices on the National Rent Report's list of 35 cities.

GTA rent prices just saw their biggest increase so far this year https://t.co/u08gHpZyry #Toronto #GTA #RealEstate

— blogTO (@blogTO) June 2, 2022

It's a similar story playing out across the province, with Ontario registering the second-highest monthly rent among Canadian provinces in June, the average monthly cost of a unit rising by 14 per cent year-over-year to $2,232.

Even with all of this price appreciation forcing tenants to dig deeper into their wallets, June's average rents still fall below pre-lockdown levels. In June 2019, Ontario's average monthly rent sat at $2,279, a difference of $47.

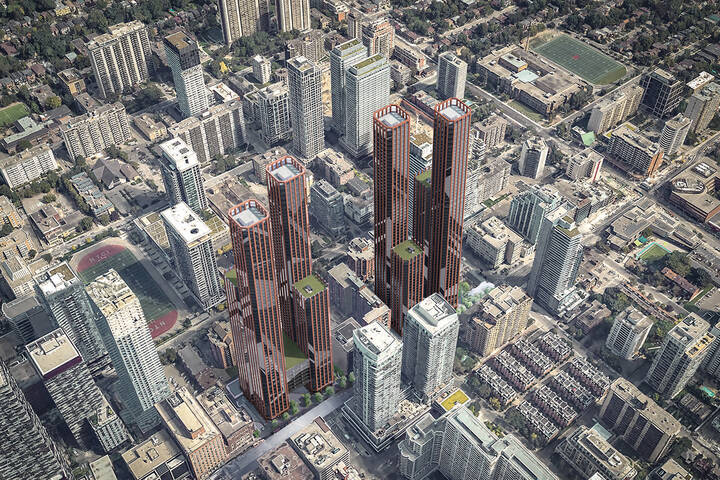

The report cites recent data from the CMHC that points to critically undersupplied housing stock. At the same time, Rentals.ca and Bullpen Research & Consulting stress the effects of rising interest rates, inflation, supply chain issues, and the return of in-office work requirements.

Though the report admits that "it is difficult to forecast during these unpredictable times," analysts only expect rent price growth to continue.

Latest Videos

Latest Videos

Join the conversation Load comments