Toronto home sales have dropped by nearly 50% but prices aren't following suit

With only 4,912 homes sold throughout the entire Greater Toronto Area in July of this year — some 47 per cent less compared to July 2021 — the predictions of real estate experts and analysts continue to play out as promised. For better (in the case of some buyers) or worse (sorry, sellers).

The Toronto Regional Real Estate Board (TRREB) released its monthly stats report for July 2022 on Thursday, noting that both sales volumes and new listings were down on a year-over-year and month-over-month basis across the region.

Home prices are up ever so slightly at 1.2 per cent compared to last year at this time, but the average (seasonally-adjusted) selling price actually fell 2.6 per cent between June and July, from $1,137,494 to $1,108,158.

A 2.6 per cent average price drop for the GTA isn't amazing, but it's better than what prospective buyers were looking at last summer, when prices were rising by as much as 2.8 per cent every month.

"Market conditions remained much more balanced in July 2022 compared to a year earlier. As buyers continued to benefit from more choice, the annual rate of price growth has moderated," reads the TRREB report released Aug. 4.

These figures doen't tell the whole story, however; Prices aren't falling across the board, in every part of the region, across every housing type.

"Less expensive home types, including condo apartments, experienced stronger rates of price growth as more buyers turned to these segments to help mitigate the impact of higher borrowing costs," notes TRREB, which reports a 7.6 per cent average price increase for townhouses in the City of Toronto.

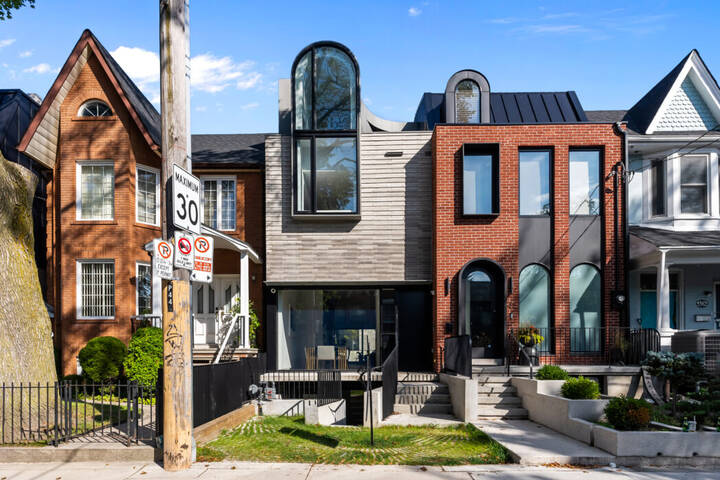

The benchmark price of a newly-built single family house in Toronto recently shot up 31 per cent, year-over-year, hitting $1,843,595.

Condos in the 416 were also up, 4.3 per cent year-over-year, while condos in the suburbs were some 11.9 per cent more expensive than they were last year at the same time. Conversely, detached homes in Toronto posted a 7.3 per cent price drop, versus a 1.9 per cent price drop in the 905.

And yet, The MLS® Home Price Index (HPI) Composite Benchmark, which "measures the rate at which housing prices change over time taking into account the type of homes sold," shows a 12.9 per cent year-over-year increase across the region.

The bottom line is that prices aren't following the same steep downward trend as sales or listings.

TRREB expects the rate of new listings to follow the rate of sales well into the second half of 2022 and into 2023, but prices are hard to predict. Could this market correction turn into a market crash?

Market analysts say that immediate government intervention is needed to offset rapidly-increasing mortgage rates and other housing affordability challenges.

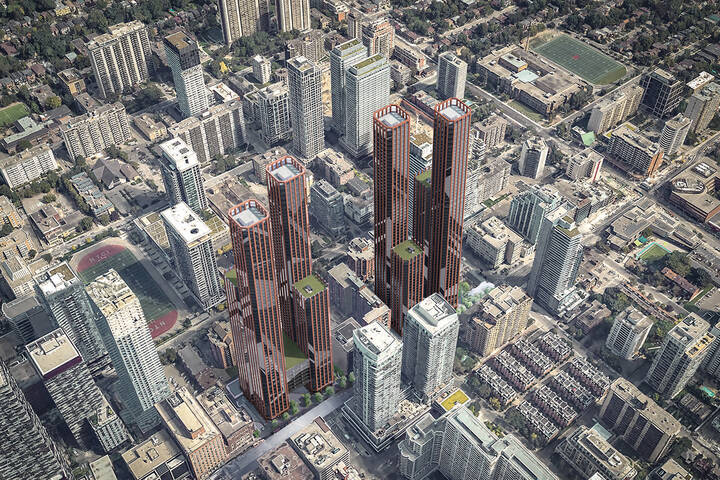

"The Greater Toronto Area (GTA) population continues to grow and tight labour market conditions will drive this growth moving forward," said TRREB Chief Market Analyst Jason Mercer.

"Policymakers must continue to take action to boost housing supply to account for long-term population growth... With savings high and the unemployment rate still low, home buyers will eventually account for higher borrowing costs. When they do, we want to have an adequate pipeline of supply in place or market conditions will tighten up again."

Lauren O'Neil

Latest Videos

Latest Videos

Join the conversation Load comments