These are the cheapest and most-heavily taxed Ontario cities to buy a home

Purchasing a home or condo whether you're a first-time buyer or not can be a stressful experience, especially when you factor in the closing costs you'll have to manage once you've reached the end of your property-buying journey.

One of the major costs you'll have to factor in when deciding to purchase a home or condo is land transfer tax (LTT).

Prospective buyers in Toronto must pay both the Ontario provincial LTT, and municipal LTT, which is determined based on the total purchase price of a property.

Although first-time buyers are eligible for rebates up to $4,000, trying to find a home in some of Ontario's hottest real estate markets at an affordable price can be made even more challenging with the tax.

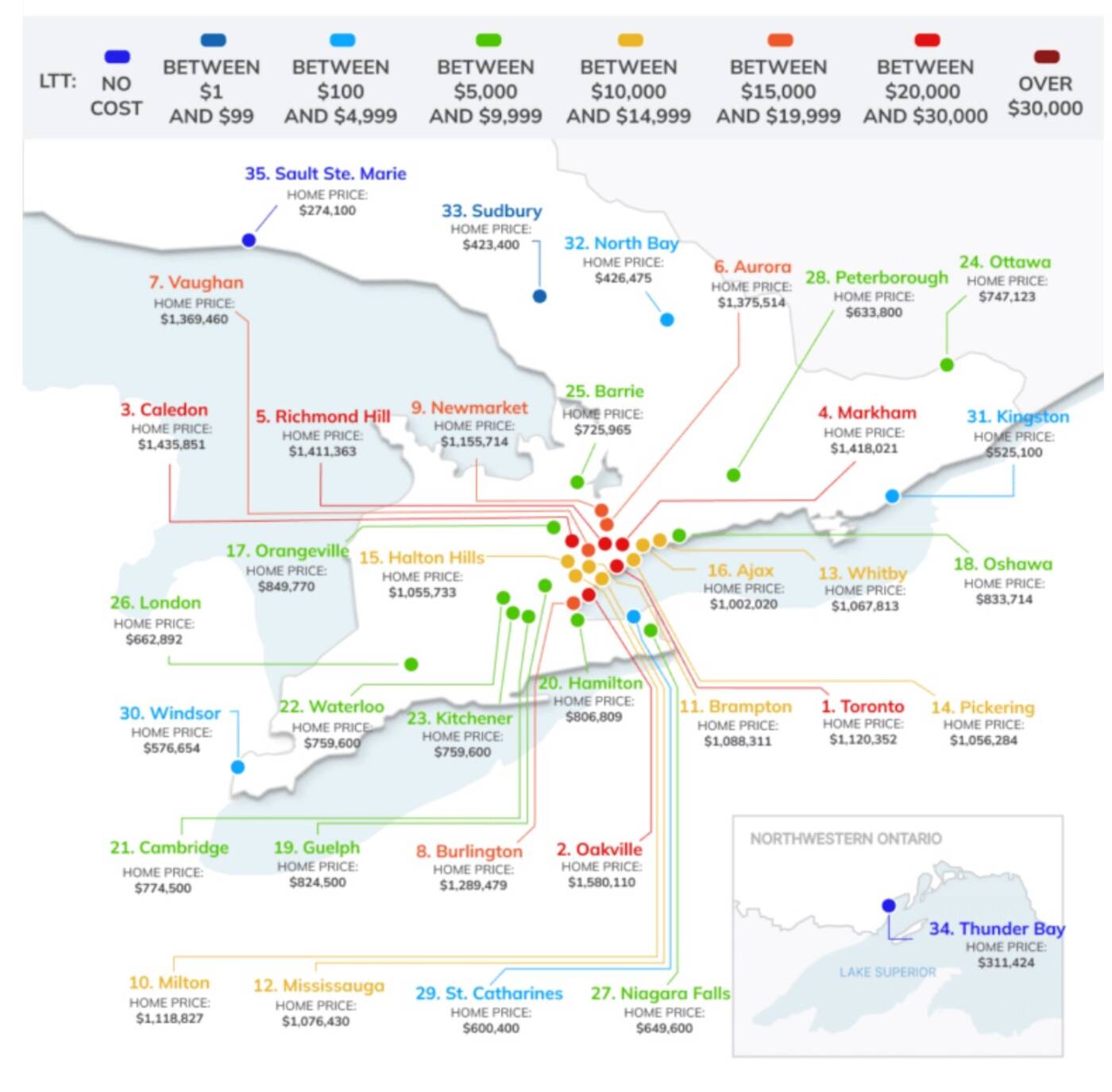

A recent Zoocasa study analyzed 35 markets across Ontario to determine which cities prospective buyers would pay the most and least in LTT, and how much more expensive it would be for repeat buyers to purchase a new property without the added cushion of a rebate.

Ontario cities with the highest and lowest land transfer tax (LTT) in 2023. Source: Zoocasa.

The study revealed that first-time home buyers in Toronto could pay $29,289 in LTT for a home at the current average price of $1,120,362. Repeat Toronto buyers face much higher costs, as the extra municipal tax means an increased cost of $37,764 on a home at the current average price.

In Sault Ste. Marie and Thunder Bay, Zoocasa found that first-time buyers wouldn't have to pay any LTT due to the rebate of $4,000, since the LTT for a home at the current average price is less than the rebate.

Ontario cities with the highest and lowest land transfer tax (LTT) in 2023. Source: Zoocasa.

Aside from these two cities, the lowest LTT was found in Sudbury, where buyers of a home at the current average price of $423,400 would only have to pay $963 in LTT.

Closer to the GTA, Ajax is the lowest-priced city over the $1 million mark, where buyers of a home at the average price of $1,002,020 can expect to pay $12,125 in LTT.

Ontario cities with the highest and lowest land transfer tax (LTT) in 2023. Source: Zoocasa.

It also comes as no suprise that the most expensive cities for both first-time and repeat buyers in terms of LTT are Toronto, Oakville, Caledon, Markham, and Richmond Hill.

You can find the full study here.

Jack Landau

Latest Videos

Latest Videos

Join the conversation Load comments