More than two thirds of condo investors in Toronto plan to sell due to new vacant home tax

The vacant home tax that residents have long been calling for in the competitive, overvalued Toronto housing market was at long last formally recommended and then approved by City Council late last year, and it's already shaping up to impact the landscape as hoped.

Long overdue

— Dan Z 🇨🇦🇦🇺🇳🇴 (@djzh) September 22, 2020

According to a recent survey conducted the Toronto Regional Real Estate Board (TRREB), residential property owners who may already be scrambling to sell off their investment properties in the city due to falling rent prices and high rental supply are also considering doing so due to the tax they will soon have to pay on empty units.

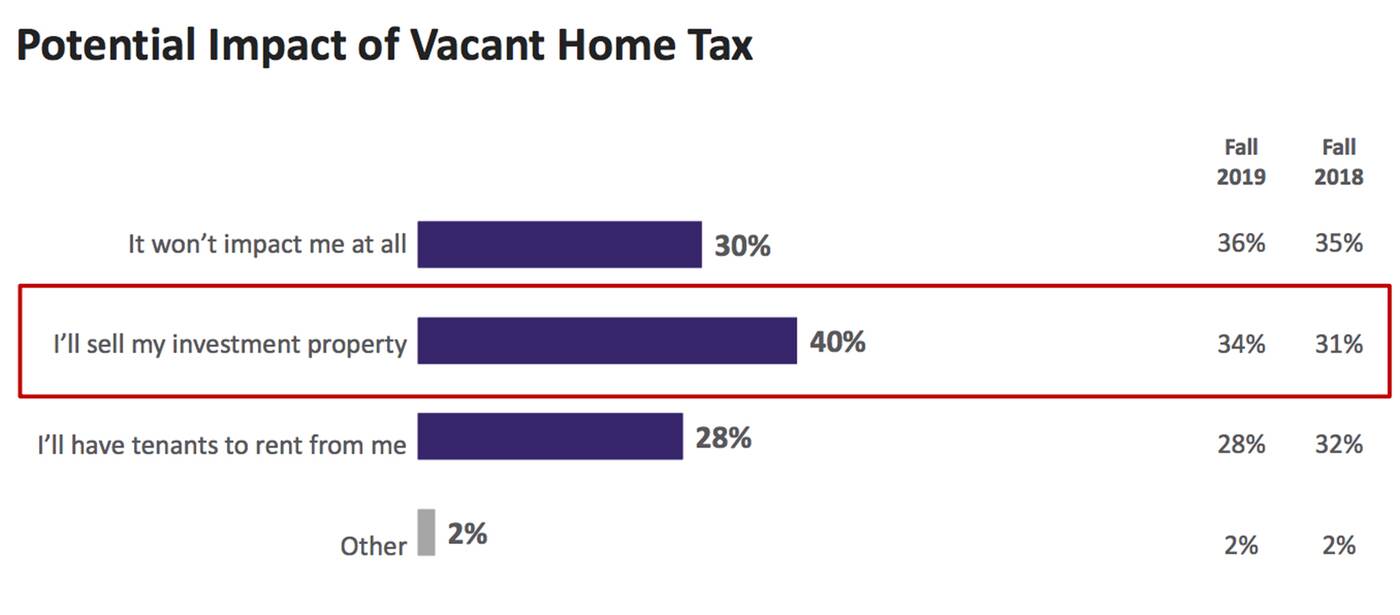

A total of 40 per cent of those polled at the end of last year said that they intend to sell their investment property in the next year, which is a 6 per cent increase from 2019 and a 9 per cent increase from 2018.

When looking at those who invested in condos specifically, that number became even more drastic, with more than a whopping two-thirds of owners considering selling according to TRREB's Market Year in Review and Outlook 2021, in part due to a prospective vacancy tax, as well as further restrictions on Airbnbs.

Investors responses to Toronto's proposed vacant home tax before it was green lit. Chart from TRREB and IPSOS's Market Year in Review and Outlook 2021.

Another 28 per cent of all respondents said they plannned to rent long-term if the vacancy tax, which hadn't yet been confirmed at the time of the survey, was instated.

Meanwhile, 30 per cent said they would not be impacted enough to change their plans due to the tax, which is notably 6 per cent less than the year prior.

TRREB has been up front in asking the City to be prudent with its implementation of the tax, calling for exemptions for snowbirds, U.S. citizens, commuters and other groups.

"It is important to have a clear understanding of the intended purpose and policy objective of a municipal tax on vacant homes in Toronto. Given the current state of the Toronto rental market, the purpose of such a tax is not immediately clear at this time," the board's president, Lisa Patel, said in a statement in December.

"TRREB is not opposed to a vacant home tax, and we understand the rationale behind it; however, it is unclear whether it will add afforable rental housing or affordable home ownership to the market," she added, pointing out that some investors may now choose to sell their unit rather than rent it out, which could affect rental supply.

TRREB Urges Council to Include Appropriate Exemptions in Toronto Vacant Home Tax Debate https://t.co/LtAUvWSnac

— REWoman (@REWoman) December 17, 2020

The idea of the tax is in part to curb foreign investment — which still accounts for around $38 billion of our housing supply despite a non-resident speculation tax— as well as ghost hotels, flipping, and other such phenomenon to free up property for those who actually live here and hopefully even bring prices into a more realistic realm.

Hector Vasquez

Latest Videos

Latest Videos

Join the conversation Load comments