Canadian mortgage rates predicted to begin drops starting this spring

Some relief is coming for Canada's indebted borrowers and prospective homebuyers who have been waiting on the sidelines for better marketplace conditions to buy a home.

According to a new report by the British Columbia Real Estate Association (BCREA), it is "overwhelmingly likely" that the Bank of Canada will begin lowering its policy interest rate at some point later in 2024.

There is growing agreement amongst analysts that the Bank of Canada's first cut to the policy interest rate could come during the scheduled June 2024 announcement, with a potential 0.25 per cent cut sending the rate down from 5.0 per cent to 4.75 per cent.

This will represent the start of a years-long cycle of lowering the rate from its current maintained peak of 5.0 per cent to possibly 2.5 per cent by the end of the cutting cycle.

There is also a possibility that the first policy interest rate cut could come as early as the April 2024 announcement. The Bank of Canada has made it clear that it will not begin its cutting cycle until it is confident that core inflation is below 3 per cent, so that they do not have to reverse course on the cutting cycle later on, which was a measure they unexpectedly took in the middle of 2023.

The core inflation rate has seen consecutive month-over-month, reaching 3.4 per cent in December 2023, 2.9 per cent in January 2024, and 2.8 per cent in February 2024.

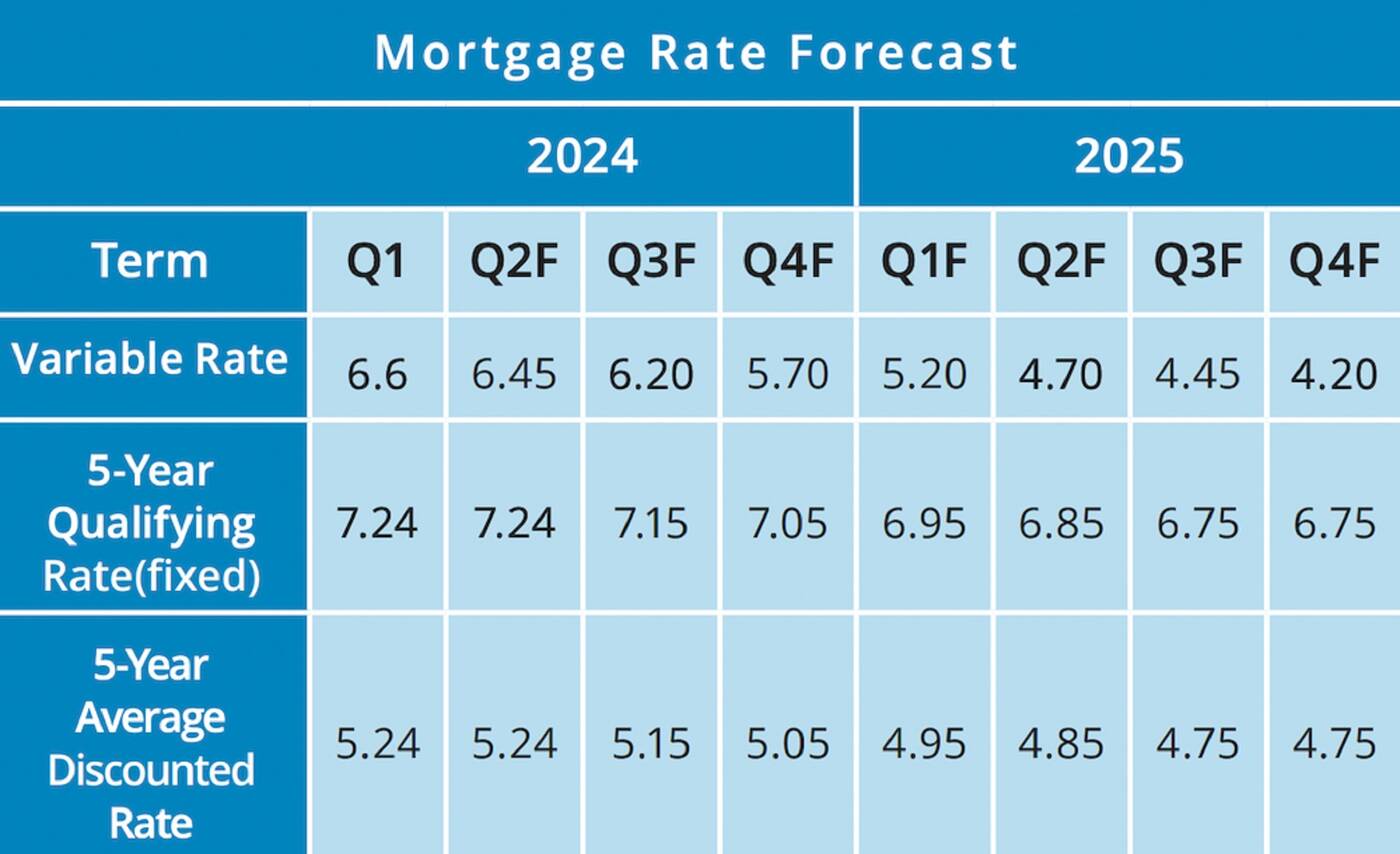

As for the mortgage rate forecast, as of now, the variable rate is expected to gradually fall from 6.6 per cent in the first quarter of 2024 to 6.45 per cent in the second quarter of 2024. After further consecutive drops, the variable rate could reach 5.7 per cent by the fourth quarter of 2024 and 4.2 per cent by the fourth quarter of 2025.

A more substantial downward trend in the variable rates will depend on the Bank of Canada making the first move. But once the Bank of Canada begins its cutting cycle, it is anticipated variable rates will fall by about 1 per cent by the end of 2024.

As for the five-year fixed rate, expect it to remain at 7.24 per cent throughout the first half of 2024, with its first cut in the third quarter of 2024 to 7.15 per cent, followed by another decline to 7.05 per cent in the fourth quarter of 2024. By the end of 2024, the five-year fixed rate could reach 6.75 per cent.

Correspondingly, the Canadian Real Estate Association (CREA) also recently separately reported that the country's housing market appears to be turning a corner. Home prices nationwide remained flat in February 2024, representing the first month of zero change month-over-month, and following five consecutive months of decreases since late 2023.

Over the past two decades, there have only been three other times when there has been a sudden improvement or increase in the month-over-month home price percentage change from one month to the next of this size.

However, BCREA also notes that while Canada appears to have avoided the much-expected technical recession, the "Canadian economy appears rather sickly by a wide range of measures."

This includes the country's falling real GDP per capita, the poor productivity relative to population, the negative spending by households and businesses, the weak growth of real gross domestic income, which is the total of Canadian wage and profits.

Spiroview Inc/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments