Here's how long it would take the average person in Toronto to save up for a house

Once upon a time, or so I've been told, buying a home in Canada was as easy as graduating high school, getting a job at a factory, and then coughing up a few months' wages for a down payment on your family-sized starter home.

Such is not the case today anywhere in Canada, let alone in Toronto, where the average price for a detached house now rings in at around $1.75 million.

With crippling student debt (and without significant help from one's parents), it's become hard for millennial workers to enter the real estate market at all.

Even shoebox condos, the last bastion of affordability for young urbanites, have become unattainable for many people as demand outweighs supply and drives prices back up after a brief COVID-induced lull.

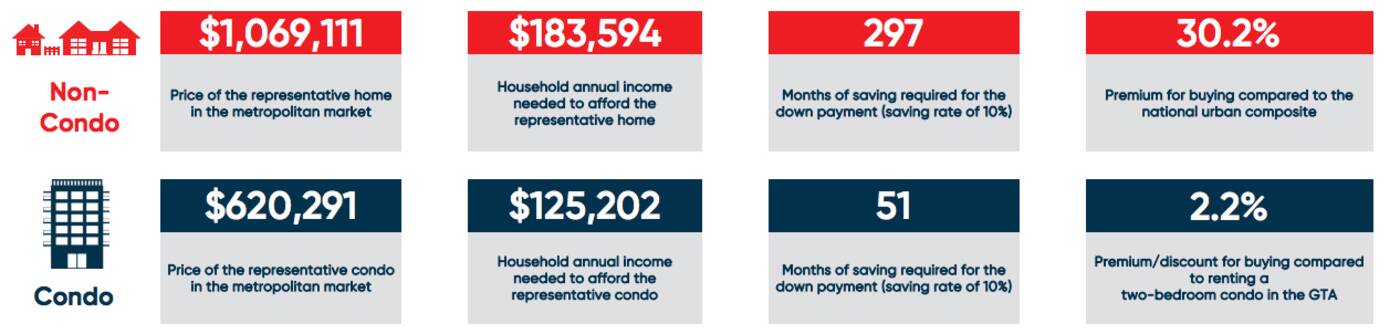

According to The National Bank of Canada (NBC)'s latest housing affordability monitor, released Tuesday, the average annual household income needed to afford a representative house in Toronto is currently around $183,594.

That's the income it would take to buy a house that costs $1,069,111, which was the price of a "representative home in the metropolitan market" over the first quarter of 2021, according to the bank.

And even with that income of more than $183,000, someone would have to save up for a staggering 297 months just to afford a down payment on their seven figure Toronto home.

That's nearly 25 years of saving 10 per cent of one's income, every month, just to afford the 20 per cent down payment necessary to secure a house that they'd spend decades more paying off through a mortgage.

It's no wonder that nearly half of Ontario residents under the age of 40 have already given up on the dream of home ownership.

Housing became less affordable in Toronto throughout the first quarter of 2021, according to analysts. Image via National Bank of Canada.

"Housing affordability in Canada worsened in the first quarter of 2021, marking the sharpest deterioration since 2018-Q4," reads the NBC report. "In Toronto, the median home price crossed the $1 million mark in QI, the minimum down-payment to buy a house now stands at 20 per cent."

Condos are still a better bet for people looking to buy their first homes in Toronto, with a representative price of $620,291 in the first quarter of 2021 and an average income of $125,202 required to afford a condo at that price.

Of course, a lot of people have been leaving the city in recent months to get more bang for their buck in smaller regions, where $600,000 will score you a four-bedroom home as opposed to a bachelor pad.

"In Greater Toronto, it takes decades just to save the minimum down payment for a non-condo. The median household needs to save for 24.74 years as of Q1 2021, for the minimum down payment," writes Better Living co-founder Stephen Punwasi of the data.

"Historically, the average has only been 4.85 years, so it's about 410 per cent longer these days," continues Punswasi.

"A 25-year-old household would be around 50 by the time they saved for the extra space. Just in time to have kids, right?"

F*ck.

Latest Videos

Latest Videos

Join the conversation Load comments